Monday, October 5, 2009

Emerging-market telecoms: Will the valuations stay around for a year or two ?

Emerging-market telecoms: Emerging-market telecoms are in hot demand – so much so that the valuation attributed to Kuwait-based operator Zain Telecom by a consortium of Asian investors seems, well, zany.

Emerging-market telecoms: Emerging-market telecoms are in hot demand – so much so that the valuation attributed to Kuwait-based operator Zain Telecom by a consortium of Asian investors seems, well, zany.

India’s Vavasi Group and Malaysian billionaire Syed al-Bukhary have provisionally agreed to pay $13.7 billion for a 46 per cent stake in Zain, according to Kuwait’s Kharafi Group, the family conglomerate leading the selling shareholders.

The implied near-$30 billion valuation for Zain looks rich. The price of 2 Kuwaiti dinars per a Zain share is equivalent to a premium of 89 per cent on the July 9 market price. That was when the group revealed it was in separate talks to sell a majority stake in its African assets to French conglomerate Vivendi. The African business accounts for roughly 60 per cent of Zain's total customers and 15 per cent of net profit. The talks with Vivendi subsequently collapsed.

The Asian deal values Zain at 10 times this year’s forecast ebitda. The valuation may be less toppy after factoring in the lower tax rates in Gulf markets. The Middle East is considered mature in terms of mobile penetration, even if Zain is exposed to high-growth markets in Africa. But it's hard to see why Zain is worth a lot more than the 7-times-ebitda that Vivendi is now looking to pay for GVT in Brazil, another fast-growing market.

What’s more, Zain’s new Asian investors aren’t even getting a majority stake. The 46 per cent holding will sit alongside the Government of Kuwait’s 25 per cent investment. True, the government is understood to have just one board seat. And it has been content to let the Kharafi Group control half of the board with a direct stake of less than 15 per cent, according to bankers close to the company. But there is no guarantee that Zain’s new foreign owners will have as much influence with their holding in the poorly regulated Kuwaiti market.

In any case, this does not sound like a done deal. Little is known about India’s Vavasi Group, and the bidding consortium may yet grow to include two more Indian state-controlled telecom companies. The Asian investors also appear to remain undecided how the purchase will be carved up between them. The source of funding is also unclear. If this actually comes off, it will be a great deal for the vendor. But that is still a big if.

For further commentary see www.breakingviews.com

Emerging-market telecoms: Emerging-market telecoms are in hot demand – so much so that the valuation attributed to Kuwait-based operator Zain Telecom by a consortium of Asian investors seems, well, zany.

India’s Vavasi Group and Malaysian billionaire Syed al-Bukhary have provisionally agreed to pay $13.7 billion for a 46 per cent stake in Zain, according to Kuwait’s Kharafi Group, the family conglomerate leading the selling shareholders.

The implied near-$30 billion valuation for Zain looks rich. The price of 2 Kuwaiti dinars per a Zain share is equivalent to a premium of 89 per cent on the July 9 market price. That was when the group revealed it was in separate talks to sell a majority stake in its African assets to French conglomerate Vivendi. The African business accounts for roughly 60 per cent of Zain's total customers and 15 per cent of net profit. The talks with Vivendi subsequently collapsed.

The Asian deal values Zain at 10 times this year’s forecast ebitda. The valuation may be less toppy after factoring in the lower tax rates in Gulf markets. The Middle East is considered mature in terms of mobile penetration, even if Zain is exposed to high-growth markets in Africa. But it's hard to see why Zain is worth a lot more than the 7-times-ebitda that Vivendi is now looking to pay for GVT in Brazil, another fast-growing market.

What’s more, Zain’s new Asian investors aren’t even getting a majority stake. The 46 per cent holding will sit alongside the Government of Kuwait’s 25 per cent investment. True, the government is understood to have just one board seat. And it has been content to let the Kharafi Group control half of the board with a direct stake of less than 15 per cent, according to bankers close to the company. But there is no guarantee that Zain’s new foreign owners will have as much influence with their holding in the poorly regulated Kuwaiti market.

In any case, this does not sound like a done deal. Little is known about India’s Vavasi Group, and the bidding consortium may yet grow to include two more Indian state-controlled telecom companies. The Asian investors also appear to remain undecided how the purchase will be carved up between them. The source of funding is also unclear. If this actually comes off, it will be a great deal for the vendor. But that is still a big if.

For further commentary see www.breakingviews.com

Discovering life beyond number portability :Live Mint

The telecom industry has spawned some of the last decade’s favourite ad campaigns, built and on occasion, rebuilt brands from scratch. It has consistently innovated on price and geographic spread and now earns gross revenue of over Rs39,000 crore a year, according to Telecom Regulatory Authority of India (Trai) estimates. But the end of the year brings with it one of the sector’s biggest challenges yet —the launch of mobile number portability.

In spite of many countries having preceded India, the impact that portability is likely to have on this market is anyone’s guess.

For instance, it was introduced in the US in 2003 and accounted for over half of the 33% churn which took place that year.

On the other hand, in Brazil, a prepaid dominated market such as India, portability caused an incremental churn of just 1-1.5% marketeers and analysts are betting more heavily on the latter outcome given that India is already a volatile market with annual churn of 40%.

According to Daniel Yu, Asia-Pacific analyst for Pyramid Research, “Mobile number portability will definitely increase overall churn, but not significantly. Operators will focus on the post-paid subscribers rather than prepaid market segment.” Shankari Panchapakesan, executive director, telecom practice, The Nielsen Company, adds: “We expect number portability at a national level will pretty much be a blip. The high spend segment is far more prone. And new entrants will be able to see a big impact if they leverage this platform right.”

As many as four mobile-phone firms are expected to launch operations in India, not counting recent entrants such as Tata Docomo. While the likes of Bharti Airtel Ltd, Vodafone Essar Ltd and Reliance Communications Ltd have spent the better part of this decade building large customer bases, the newer brands are preparing to woo at least some of these away.

What’s encouraging them is a spate of recent surveys which indicate that the lucrative post-paid category is likely to see the highest levels of churn. Market researcher IMRB’s Switch study pegs the figure at 50%, while Nielsen’s Mobile Consumer Insights indicates that the churn is likely to be strongest in the high spending subset.

In spite of accounting for a meagre 10% of the market, the post-paid segment has an average revenue per user, or Arpu, that’s thrice as much as prepaid, bolstered no doubt by big spenders with corporate accounts.

Abdul Khan, head-GSM marketing Tata Teleservices Ltd, says: “A lot of legacy post-paid users in the business segment have to make do with a network which may not be as good as it was when they started. They would probably be the people who would look for an opportunity to move out.”

The switching is likely to be further incentivized by the fact that mobile phone companies have thus far not really made customer retention or loyalty a priority.

With a few rare exceptions, both brand communication and the services on offer have been undifferentiated.

“Operators are taking the high value consumer for granted,” says marketing consultant Pranesh Misra, chairman and managing director of Brandscapes Worldwide. “Sometimes they have corporate arrangements and, therefore, get consumers trapped in. You may spend Rs20,000 a month or Rs40,000 a month as a highvalue customer, but they don’t really recognize you. They throw all kinds of SMS messages at you, and when you call for help, you go through an interactive voice response like any ordinary Rs200 a month consumer. That’s where companies have to wake up and see how they can differentiate.”

Marketing spending is expected to rise post-portability, as incumbents scramble to fence their subscribers in, and new players announce competitive rates and less cluttered networks. But this time around, the communication will no longer be built on a one-size-fits-all, acquisition- driven approach. It will be targeted sharply on the high-end segment of post-paid consumers.

Perhaps belatedly, customer retention and loyalty programmes will become far more critical. Pradeep Shrivastava, chief marketing officer, Idea Cellular Ltd, says: “Perhaps it is high time operators had a greater focus on customer service. Now your existing subscribers have a choice to move on the same number. The focus is going to be more in terms of ensuring you have fewer and fewer dissatisfied customers. It’s not so much about publicizing who you are; it’s delivering who you are which is going to be critical.”

In a post-portability world, lovable dogs, precocious children and anthemic jingles are likely to lose out to cold hard facts on better networks, a differentiated offering and higher levels of customer service.

cnbctv18@livemint.com

In spite of many countries having preceded India, the impact that portability is likely to have on this market is anyone’s guess.

For instance, it was introduced in the US in 2003 and accounted for over half of the 33% churn which took place that year.

On the other hand, in Brazil, a prepaid dominated market such as India, portability caused an incremental churn of just 1-1.5% marketeers and analysts are betting more heavily on the latter outcome given that India is already a volatile market with annual churn of 40%.

According to Daniel Yu, Asia-Pacific analyst for Pyramid Research, “Mobile number portability will definitely increase overall churn, but not significantly. Operators will focus on the post-paid subscribers rather than prepaid market segment.” Shankari Panchapakesan, executive director, telecom practice, The Nielsen Company, adds: “We expect number portability at a national level will pretty much be a blip. The high spend segment is far more prone. And new entrants will be able to see a big impact if they leverage this platform right.”

As many as four mobile-phone firms are expected to launch operations in India, not counting recent entrants such as Tata Docomo. While the likes of Bharti Airtel Ltd, Vodafone Essar Ltd and Reliance Communications Ltd have spent the better part of this decade building large customer bases, the newer brands are preparing to woo at least some of these away.

What’s encouraging them is a spate of recent surveys which indicate that the lucrative post-paid category is likely to see the highest levels of churn. Market researcher IMRB’s Switch study pegs the figure at 50%, while Nielsen’s Mobile Consumer Insights indicates that the churn is likely to be strongest in the high spending subset.

In spite of accounting for a meagre 10% of the market, the post-paid segment has an average revenue per user, or Arpu, that’s thrice as much as prepaid, bolstered no doubt by big spenders with corporate accounts.

Abdul Khan, head-GSM marketing Tata Teleservices Ltd, says: “A lot of legacy post-paid users in the business segment have to make do with a network which may not be as good as it was when they started. They would probably be the people who would look for an opportunity to move out.”

The switching is likely to be further incentivized by the fact that mobile phone companies have thus far not really made customer retention or loyalty a priority.

With a few rare exceptions, both brand communication and the services on offer have been undifferentiated.

“Operators are taking the high value consumer for granted,” says marketing consultant Pranesh Misra, chairman and managing director of Brandscapes Worldwide. “Sometimes they have corporate arrangements and, therefore, get consumers trapped in. You may spend Rs20,000 a month or Rs40,000 a month as a highvalue customer, but they don’t really recognize you. They throw all kinds of SMS messages at you, and when you call for help, you go through an interactive voice response like any ordinary Rs200 a month consumer. That’s where companies have to wake up and see how they can differentiate.”

Marketing spending is expected to rise post-portability, as incumbents scramble to fence their subscribers in, and new players announce competitive rates and less cluttered networks. But this time around, the communication will no longer be built on a one-size-fits-all, acquisition- driven approach. It will be targeted sharply on the high-end segment of post-paid consumers.

Perhaps belatedly, customer retention and loyalty programmes will become far more critical. Pradeep Shrivastava, chief marketing officer, Idea Cellular Ltd, says: “Perhaps it is high time operators had a greater focus on customer service. Now your existing subscribers have a choice to move on the same number. The focus is going to be more in terms of ensuring you have fewer and fewer dissatisfied customers. It’s not so much about publicizing who you are; it’s delivering who you are which is going to be critical.”

In a post-portability world, lovable dogs, precocious children and anthemic jingles are likely to lose out to cold hard facts on better networks, a differentiated offering and higher levels of customer service.

cnbctv18@livemint.com

MTS DELHI launch on Fri Oct 9th

It is confirmed that MTS Delhi circle will be launched on Fri Oct 9th 2009 at Hotel Leela Kempinski Gurgaon at 7:30 PM. There will be a Russian cultural extravaganza along with flurry of Bollywood performances. The technology showcase will also be presented at the meet. The AMSOST team will bring you full coverage and pictures by saturday.

MTS INDIA ANNOUNCES KEY APPOINTMENTS IN ITS SENIOR MANAGEMENT TEAM

MTS, the mobile telephony services brand of Sistema Shyam TeleServices Ltd., has announced key senior level appointments in its top management team, including Mr. Cheenu Seshadri as Chief Strategy Officer Corporate Centre, Gurgaon; Mr. Sandeep Yadav as Chief Operating Officer for Rajasthan circle operations, and Mr. VK Cherian as Director – Corporate Communication for the Corporate Centre in Gurgaon. All of them will report directly to the SSTL President and CEO, Mr. Vsevolod Rozanov.

Welcoming the new team members, Mr. Rozanov said, “I am delighted to see the team grow and welcome them to team MTS. It gives me great satisfaction to see the further strengthening of the top management team which is important since MTS is poised for significant growth in the coming months”

The company’s Chief Strategy Officer, Mr. Cheenu Seshadri comes from Motorola, Illinois, USA, where he was the Vice President – Strategy. With a distinguished career spanning over 15 years, he brings with him a rich and diversified experience in strategy and operations. Cheenu has also held very distinguished, senior level positions with global business & strategy consulting firm, Bain & Co. in Atlanta and with JDSU, a leading provider of optical products and test and measurement solutions for the communications industry, based out of Indianapolis. Cheenu has a distinguished academic record – he is an alumnus of the prestigious BoothSchool of Management, University of Chicago. He also holds an MS, degree in Industrial Engineering from the State University of New York, Binghamton and a BS in Mechanical Engineering from the Indian Institute of Technology, Madras.

Mr. Sandeep Yadav joins as the Chief Operating Officer for Rajasthan circle and has over 17 years of experience in executive decision-making and strategic business planning with an exceptional track record in the Telecom and Hospitality industries. In his last assignment, Sandeep was heading the sales operations for Idea Cellular in the Delhi NCR region. Sandeep has also held similar senior-level roles with Idea Telecommunications, Reliance Infocomm Ltd, Hutchison Telecom Ltd and Hexacom in various parts of the country. Early in his career, he also headed the Sales Operations for ITC Group of Hotels in Delhi and Rajasthan. Sandeep did an ‘Executive Program in Business Management from the Indian Institute of Management, Calcutta.

Mr. V. K. Cherian comes on board as the Director, Corporate Communication. Mr.Cherian is a seasoned communications professional with over 29 years of experience, including 20 years in mainline media in New Delhi. He worked with The Financial Express and The Hindu Business Line. He watched closely and wrote on the boom in the Indian IT and Telecom industry and has been associated with it for over two decades. In his role as a communications consultant, among other achievements, he handled telecom major BSNL, at Concept PR Pvt. Ltd, and later as Vice President – Adfactors PR, played a key role in devising the challenging entry process strategy for Vodafone Plc into India, working closely with their corporate office. As a prolific writer, Mr. Cherian has written for foreign publications on telecom, and has also produced a weekly discussion program for Doordarshan on issues relating to telecom and IT during the dotcom boom. He was also instrumental in setting up a Khadi initiative with South Africa called Afrikhadi. Cherian began his academic life in Kerala and completed it in New Delhi at the Indian Institute of Mass Communications. Cherian also got trained at the International Institute of Journalism, Berlin.

Welcoming the new team members, Mr. Rozanov said, “I am delighted to see the team grow and welcome them to team MTS. It gives me great satisfaction to see the further strengthening of the top management team which is important since MTS is poised for significant growth in the coming months”

The company’s Chief Strategy Officer, Mr. Cheenu Seshadri comes from Motorola, Illinois, USA, where he was the Vice President – Strategy. With a distinguished career spanning over 15 years, he brings with him a rich and diversified experience in strategy and operations. Cheenu has also held very distinguished, senior level positions with global business & strategy consulting firm, Bain & Co. in Atlanta and with JDSU, a leading provider of optical products and test and measurement solutions for the communications industry, based out of Indianapolis. Cheenu has a distinguished academic record – he is an alumnus of the prestigious BoothSchool of Management, University of Chicago. He also holds an MS, degree in Industrial Engineering from the State University of New York, Binghamton and a BS in Mechanical Engineering from the Indian Institute of Technology, Madras.

Mr. Sandeep Yadav joins as the Chief Operating Officer for Rajasthan circle and has over 17 years of experience in executive decision-making and strategic business planning with an exceptional track record in the Telecom and Hospitality industries. In his last assignment, Sandeep was heading the sales operations for Idea Cellular in the Delhi NCR region. Sandeep has also held similar senior-level roles with Idea Telecommunications, Reliance Infocomm Ltd, Hutchison Telecom Ltd and Hexacom in various parts of the country. Early in his career, he also headed the Sales Operations for ITC Group of Hotels in Delhi and Rajasthan. Sandeep did an ‘Executive Program in Business Management from the Indian Institute of Management, Calcutta.

Mr. V. K. Cherian comes on board as the Director, Corporate Communication. Mr.Cherian is a seasoned communications professional with over 29 years of experience, including 20 years in mainline media in New Delhi. He worked with The Financial Express and The Hindu Business Line. He watched closely and wrote on the boom in the Indian IT and Telecom industry and has been associated with it for over two decades. In his role as a communications consultant, among other achievements, he handled telecom major BSNL, at Concept PR Pvt. Ltd, and later as Vice President – Adfactors PR, played a key role in devising the challenging entry process strategy for Vodafone Plc into India, working closely with their corporate office. As a prolific writer, Mr. Cherian has written for foreign publications on telecom, and has also produced a weekly discussion program for Doordarshan on issues relating to telecom and IT during the dotcom boom. He was also instrumental in setting up a Khadi initiative with South Africa called Afrikhadi. Cherian began his academic life in Kerala and completed it in New Delhi at the Indian Institute of Mass Communications. Cherian also got trained at the International Institute of Journalism, Berlin.

Telecom users may soon get option of paying per second

Indian telecom operators may soon be asked to compulsorily give their customers the option of paying tariff based on usage per second instead of the current per minute pulse, sector regulator Trai said today.

He said Trai may soon come out with a consultation paper on the subject and invite suggesstions about making it mandatory for operators to provide customers with this option.

"Even there (in per-second tariff plan), they must ensure to bring out clearly all the riders and caveats," Sarma noted.

The Trai chief further said that since the current regulations allow the operators to decide the tariffs on their own, "I cannot say whether the time has come to reconsider this particular clause."

Some of the telecom players in the country have already launched per-second pulse, but such tariff plans are not mandatory and are mostly aimed at expanding their penetration and expanding market share.

Last week, state-run BSNL introduced one paise per second pulse (for local calls) and two paise per second pulse (for STD) in Karnataka, Andhra Pradesh and Orissa.

Private sector Tata Teleservices broke away from the norm by offering users per second pulse on its GSM network — a development the company attributed to its becoming the top operator in terms of user additions in August.

Another operator, Aircel also extended its pay-per second calling plan from Kolkata and Orissa to Uttar Pradesh last week.

"We may ask all the operators to consider per-second pulse as a mandatory tariff option along with their other tariff plans," Telecom Regulatory Authority of India (Trai) Chairman J S Sarma told reporters on the sidelines of the International Telecommunication Union conference here.

He said Trai may soon come out with a consultation paper on the subject and invite suggesstions about making it mandatory for operators to provide customers with this option.

"Even there (in per-second tariff plan), they must ensure to bring out clearly all the riders and caveats," Sarma noted.

The Trai chief further said that since the current regulations allow the operators to decide the tariffs on their own, "I cannot say whether the time has come to reconsider this particular clause."

Some of the telecom players in the country have already launched per-second pulse, but such tariff plans are not mandatory and are mostly aimed at expanding their penetration and expanding market share.

Last week, state-run BSNL introduced one paise per second pulse (for local calls) and two paise per second pulse (for STD) in Karnataka, Andhra Pradesh and Orissa.

Private sector Tata Teleservices broke away from the norm by offering users per second pulse on its GSM network — a development the company attributed to its becoming the top operator in terms of user additions in August.

Another operator, Aircel also extended its pay-per second calling plan from Kolkata and Orissa to Uttar Pradesh last week.

The Evolving Indian Telecom and Internet Services Market

05-Oct-09 | |

With a mobile penetration of close to one in three Indians, the future of telephony in India is definitely in the mobile space. Connectivity in many parts of the country tends to be an issue, and hence the rapid growth of the mobile segment. With increasing frequency, the cell phone has become the preferred platform for value added services and even internet access. With a mobile penetration of close to one in three Indians, the future of telephony in India is definitely in the mobile space. Connectivity in many parts of the country tends to be an issue, and hence the rapid growth of the mobile segment. With increasing frequency, the cell phone has become the preferred platform for value added services and even internet access. With the fixed line internet subscriber base somewhere in the region of 45 to 50 million, mobile internet connectivity is the new frontier. There has been a great upsurge in demand for the wireless internet modems offered by companies like Tata Indicom and Reliance. A number of services including payment platforms and education and content sharing platforms are being created around the use of the cell phone. Even advertising spend reflects this, with only about 3% of the total advertising budget going to internet advertising while several times that is spent on SMS advertising across the country. To draw parallels, China is today the world’s largest sender and receiver of short text messages (SMS) with the US in second place. India with its growing mobile user base could soon be challenging these two positions. The limitation in evolving content for the mobile space is essentially the mobile service provider. Since service providers want a large chunk of the revenues, profitability for content creators is an issue. What is required is an operator-independent service which can push content to a number of networks with reasonable costs, and share in the revenue as volumes grow. SMS as a technology is great for doing so, as it is network independent to the most part, and can be designed to be permission-based rather than intrusive.  The Indian telecom services market has evolved to the point where customers are comfortable paying for services in advance, primarily due to the low penetration of credit systems in India. The success of the pre-paid model in mobile telephony is testament to the fact. If a platform can be created where customers pay up in advance and then utilize the credit balance to avail a number of services, the expansion of value added services will skyrocket. Again, the kinds of services we currently can offer are fairly simple, as maybe 1% of the mobile population is using smartphones. If content based on voice and text can gain acceptance, users can then be grown to a point where they are willing to invest in a new phone to avail of the richer content a 3G or higher platform can offer them, whether it’s streaming video, internet connectivity or a host of other applications. The opportunity for content and applications in the telephone space in India is huge. However, it will require a meeting of minds between the service providers, content providers and enablers to bring it about. Source: |

Great Response from shareholders !

The AMSOST team is overwhelmed with the response from the shareholders, thanking us for providing this platform to keep abreast of the news and the market pricing.

We will continue to strive hard until we reach our goal of the IPO. We intend to reach out to each and every shareholder and want your support in helping us in doing the same

We will continue to strive hard until we reach our goal of the IPO. We intend to reach out to each and every shareholder and want your support in helping us in doing the same

Next 3 years crucial for mobile operators :Economic Times

MUMBAI: There has never really been a better time for a consumer with a mobile phone. If tariffs have moved southwards to levels of less than Re 1

per minute, the next round of the telecom war has just unfolded. Consumers have been spoilt for choice with changes in the tariff structure and really paying for just the time spent on the mobile, though it could well be a case of operators' margins being hit.

When Tata DoCoMo launched its per second billing offer earlier this year, it was apparent that the other operators would retaliate. From a time when pulse rates were calculated on a per minute basis, the user was paying one paisa for each second of conversation. "This is based on the concept of fairness and pay-to-use," said Abdul Khan, head (Tata DOCOMO marketing), Tata Teleservices (Maharashtra). In the first month of the launch of Tata DoCoMo (this is a GSM service) in Maharashtra, it brought in over a million subscribers. "Tariff is just one manifestation of what we stand for. The focus will be on the overall customer experience," he added. The company has also announced the tariff for short messaging service at 1 paise per character.

India, apart, from being the fastest growing telecom market in the world, remains the most competitive as well. Low tariffs, with a host of freebies, make it hugely important for operators to have deep pockets. The average revenue per user (ARPU), a key indicator of an operator's financial soundness, has dropped steadily to a level below Rs 300 today. Factors like a large chunk of pre-paid users, which is well over 90% of the total subscriber base, has not deterred operators.

Vodafone-Essar, with a subscriber base in excess of 80 million, has just announced a special package on a region-specific basis. For instance, those in the south can make calls within the region at 50 paise per minute. Referring to the most recent offer, the spokesperson said: "We come up with market innovations which provide enhanced value to our customers, enable them to structure telecom spends according to their seasonal needs and allow us to be flexible in our offerings."

The country's largest operator, Bharti Airtel with over 107 million subscribers, has just launched its Advantage Plan where its users can make calls on the Airtel network for 50 paise per minute. Tata Indicom, a CDMA operator, has announced its pay-per-call offer where local calls will cost Re 1, while STD calls will be Rs 3 for unlimited time duration.

According to Pradeep Shrivastava, chief marketing officer, Idea Cellular, pricing is merely one part of any operator's overall strategy. "Players will have to identify their strengths and make competitive offerings. Factors like quality of a network or its reach are also very important," he said. His company is now offering local and STD calls at 50 paise per minute.

Industry trackers think the objective of these decisions is to retain market share and have an entry barrier for the new operators. "EBITDA margins will certainly be hit and will certainly drop in FY10," predicts KPMG India head of telecom practice, Romal Shetty.

For now, the new scenario is all set to take charge. "This will be the phase of real competition and the next three years will be the most crucial for Indian telecom," he added. How the surge in subscriber numbers with dropping margins for operators make for a sustainable business model will be the story to watch.

When Tata DoCoMo launched its per second billing offer earlier this year, it was apparent that the other operators would retaliate. From a time when pulse rates were calculated on a per minute basis, the user was paying one paisa for each second of conversation. "This is based on the concept of fairness and pay-to-use," said Abdul Khan, head (Tata DOCOMO marketing), Tata Teleservices (Maharashtra). In the first month of the launch of Tata DoCoMo (this is a GSM service) in Maharashtra, it brought in over a million subscribers. "Tariff is just one manifestation of what we stand for. The focus will be on the overall customer experience," he added. The company has also announced the tariff for short messaging service at 1 paise per character.

India, apart, from being the fastest growing telecom market in the world, remains the most competitive as well. Low tariffs, with a host of freebies, make it hugely important for operators to have deep pockets. The average revenue per user (ARPU), a key indicator of an operator's financial soundness, has dropped steadily to a level below Rs 300 today. Factors like a large chunk of pre-paid users, which is well over 90% of the total subscriber base, has not deterred operators.

Vodafone-Essar, with a subscriber base in excess of 80 million, has just announced a special package on a region-specific basis. For instance, those in the south can make calls within the region at 50 paise per minute. Referring to the most recent offer, the spokesperson said: "We come up with market innovations which provide enhanced value to our customers, enable them to structure telecom spends according to their seasonal needs and allow us to be flexible in our offerings."

The country's largest operator, Bharti Airtel with over 107 million subscribers, has just launched its Advantage Plan where its users can make calls on the Airtel network for 50 paise per minute. Tata Indicom, a CDMA operator, has announced its pay-per-call offer where local calls will cost Re 1, while STD calls will be Rs 3 for unlimited time duration.

According to Pradeep Shrivastava, chief marketing officer, Idea Cellular, pricing is merely one part of any operator's overall strategy. "Players will have to identify their strengths and make competitive offerings. Factors like quality of a network or its reach are also very important," he said. His company is now offering local and STD calls at 50 paise per minute.

Industry trackers think the objective of these decisions is to retain market share and have an entry barrier for the new operators. "EBITDA margins will certainly be hit and will certainly drop in FY10," predicts KPMG India head of telecom practice, Romal Shetty.

For now, the new scenario is all set to take charge. "This will be the phase of real competition and the next three years will be the most crucial for Indian telecom," he added. How the surge in subscriber numbers with dropping margins for operators make for a sustainable business model will be the story to watch.

Number Portability : A hit or miss for the new operators ?

|

It has been a long wait for Payal Mitra, a 26-year-old public relations executive in Calcutta. Mitra was one of the first in her college to use a mobile phone. Being a gadget freak, she has changed her handset 14 times in the last eight years but she still retains the first number she had.

Brand loyalty? Not really. There have been times when Mitra wanted to shift to a new service provider for less expensive call rates or other features. But she desisted from doing so since switching to a new service provider would have meant accepting a new number. And she did not want the hassle of having to inform everyone about her new number.

People like Mitra can now rejoice. Mobile number portability (MNP) is finally being implemented in India — which means that consumers can now switch between service providers without having to change their mobile numbers.

There has been talk of introducing MNP in India for quite a few years. But telecom operators had opposed the move, saying that number portability should be implemented on fixed line services as well and that MNP would involve a lot of cost on their part as it would require the networks to be significantly upgraded.

In 2007, the Telecom Regulatory Authority of India (Trai) had suggested that subscribers who want to keep their numbers unchanged when shifting to a new service provider be charged a one-time fee of Rs 200 which would enable operators to recover their cost. However, even now, it is unclear what charges a customer will have to pay to avail this service. Says J.S. Sharma, chairman, Trai, “No charges have been fixed as yet. We hope to finalise them within 15 days. But we will definitely ensure that the charges are not exorbitant.”

A deadline of December 31 has been set for the implementation of MNP in metros and Category A circles (Karnataka, Tamil Nadu, Gujarat and Maharashtra) and March 20, 2010 for the rest of the country. A subscriber can apply for a change of operator only after 90 days of the date of activation of his or her mobile connection with the existing operator. According to Trai regulations, if a number has already been “ported” or moved once, it can be ported again only after 90 days from the date of the previous porting.

Trai has stipulated that subscribers will be allowed to retain their existing mobile numbers, whether they change telecom operators, or switch from one cellular mobile technology to another by the same service provider. Post-paid subscribers opting for MNP will be required to clear all bills issued prior to the date of his or her request. In the case of a pre-paid subscriber, an undertaking has to be given by the subscriber to the effect that he or she understands and agrees that upon porting the mobile number, the balance amount of talk time, if any, at the time of porting, shall lapse. A subscriber seeking MNP may also withdraw his or her application within 24 hours of submitting it. However, the porting charges won’t be refunded.

The Trai regulations envisage a maximum period of four days for the completion of the porting process in all licensed service areas except in the case of J&K, Assam and the northeast, where the maximum time allowed is 12 days. However, efforts will be made to further reduce the porting period, says Trai.

According to the Telecommunication Mobile Number Portability Regulations, 2009, published by Trai, every access provider shall facilitate the MNP service to all subscribers, both pre-paid and post-paid and shall, upon request, provide this on a non-discriminatory basis.

To implement the service, the department of telecommunication has divided the country into two zones and a mobile number portability clearing house will serve each zone (zone 1 being northern and western India, zone 2 being eastern and southern India). A clearing house is a centralised system that interconnects mobile service providers so that numbers can be ported easily between them. To further ease porting administration, the clearing house will control and track the flow of portability requests and contain a reference data base that serves as a single repository for all ported numbers.

Says Ashok Sapra, managing director, MNP Interconnection Solutions, the body entrusted with the implementation of MNP in zone 2, “Our system will automate ordering, provisioning, notification and administration for porting numbers between operators. Despite misgivings, we believe that on the whole the technological infrastructure in India will support MNP.”

So how will MNP benefit a customer? Says Sharma, “The main advantage would obviously be the fact that a customer can retain his old number even when he or she ports to a new provider, thus saving him the time and energy to pass on his new number to everyone. Second, we hope that customers will get better service from operators as there will be more competition.”

Consumer experts second this view. “MNP will be one of the most consumer-friendly initiatives as it will bring fair competition in the market. It will enable a customer to make an informed choice based on the quality of the service providers as perceived by them,” says Bejon Misra, a consumer expert associated with the Jago Grahak Jago consumer movement.

However, Misra also puts in a word of caution. “I am afraid that service providers, specially the big players, will try their best to harass customers on some pretext or another when it comes to migration because it is going to be against their interest.”

Misra has a point. Most countries witnessed a sharp rise in the number of customers switching from one service provider to another after the implementation of MNP. Says Shankari Panchapakesan, executive director, telecom practice, The Nielsen Company, India (AC Nielsen has been studying the US telecom market for nine years), “In the US, MNP was introduced in 2003. After the institution of MNP, we observed that in the first year 18 per cent of the deactivation of services was caused by MNP. The industry churn rate — the switching of subscribers from one service provider to another — increased by 22 per cent. In fact, AT&T, the market leader in US telecom services, had to suffer a substantial market share loss of 3.34 per cent.”

Of course, Indian telecom service providers are now preparing to grin and bear it. “We are prepared for MNP. But I would not like to comment on whether or not introducing it was necessary,” says Sridhar Rao, eastern zonal head, Vodafone India. So will there be any hiccups in the implementation of MNP? Says Sharma of Trai, “As of now we do not foresee any problems in implementation, but you can gauge the depth of water only when you enter it.”

Sure. And customers too will find out how smooth the operation of number portability will be once the service is launched at the end of this year.

Rural mobile teledensity doubles

Nivedita Mookerji / DNAMonday, October 5, 2009 2:16 IST

New Delhi: Rural is hot, when it comes to mobile telephony. Rural wireless teledensity has almost doubled -- to 15.35% from 8.73% -- according to the latest data available with the Telecom Regulatory Authority of India (Trai). For 100 people living in rural areas, more than 15 had mobile phone connections as of June-end. Just a year earlier -- the close of June 2008 -- it was less than nine.

Urban teledensity, meanwhile, grew to 87.18% from 63.85% in the corresponding period.The rural mobile subscriber base increased to 125.95 million in June 2009 from 70.83 million in June 2008, while that in urban areas went up to 301.34 million from 216.04 million. Among the service providers, Bharti Airtel has the maximum number of rural wireless subscribers at 33.78 million, followed by Vodafone at 24.83 million and Idea Cellular at 19.8 million.

State-owned Bharat Sanchar Nigam Ltd (BSNL) has 19.35 million rural mobile phone subscribers, while Reliance Communications has 16.36 million, Aircel has 8.82 million and Tata Teleservices, 2.93 million.

When it comes to percentage share of rural mobile subscribers, Idea Cellular tops the list, with 42.05% of its 47.09 million subscribers based in rural areas. Aircel is next with 40.47%, followed by BSNL at 35.59%, Bharti at 33%, Vodafone at 32.48%, Reliance at 20.55%, Tata Teleservices at 7.89% and Sistema at 5.29%.

When you look at the total rural phone subscriber base (mobile and landline)

too, Bharti comes out on top with 33.78 million. BSNL has 29.64 million rural subscribers, Vodafone with 24.83 million, Idea with 19.80 million, Reliance with 16.36 million, Aircel with 8.82 million, and Tata Teleservices with 2.96 million.

At the close of June 2009, the country had a total of 464.82 million phone subscribers. Out of this, 70.7% -- or 328.55 million -- were urban subscribers while 136.27 million were rural users. The total teledensity in the country was 39.86%, with urban teledensity at 95.05% and rural teledensity at 16.61%.

Fixed-line stats, however, are on a decline, with the subscriber base falling 1.14% from the quarter ending March 2009, to touch 37.53 million in June 2009.At the last count, urban fixed line teledensity was 7.87%, while rural fixed line teledensity was a dismal 1.26%.

New Delhi: Rural is hot, when it comes to mobile telephony. Rural wireless teledensity has almost doubled -- to 15.35% from 8.73% -- according to the latest data available with the Telecom Regulatory Authority of India (Trai). For 100 people living in rural areas, more than 15 had mobile phone connections as of June-end. Just a year earlier -- the close of June 2008 -- it was less than nine.

Urban teledensity, meanwhile, grew to 87.18% from 63.85% in the corresponding period.The rural mobile subscriber base increased to 125.95 million in June 2009 from 70.83 million in June 2008, while that in urban areas went up to 301.34 million from 216.04 million. Among the service providers, Bharti Airtel has the maximum number of rural wireless subscribers at 33.78 million, followed by Vodafone at 24.83 million and Idea Cellular at 19.8 million.

State-owned Bharat Sanchar Nigam Ltd (BSNL) has 19.35 million rural mobile phone subscribers, while Reliance Communications has 16.36 million, Aircel has 8.82 million and Tata Teleservices, 2.93 million.

When it comes to percentage share of rural mobile subscribers, Idea Cellular tops the list, with 42.05% of its 47.09 million subscribers based in rural areas. Aircel is next with 40.47%, followed by BSNL at 35.59%, Bharti at 33%, Vodafone at 32.48%, Reliance at 20.55%, Tata Teleservices at 7.89% and Sistema at 5.29%.

When you look at the total rural phone subscriber base (mobile and landline)

too, Bharti comes out on top with 33.78 million. BSNL has 29.64 million rural subscribers, Vodafone with 24.83 million, Idea with 19.80 million, Reliance with 16.36 million, Aircel with 8.82 million, and Tata Teleservices with 2.96 million.

At the close of June 2009, the country had a total of 464.82 million phone subscribers. Out of this, 70.7% -- or 328.55 million -- were urban subscribers while 136.27 million were rural users. The total teledensity in the country was 39.86%, with urban teledensity at 95.05% and rural teledensity at 16.61%.

Fixed-line stats, however, are on a decline, with the subscriber base falling 1.14% from the quarter ending March 2009, to touch 37.53 million in June 2009.At the last count, urban fixed line teledensity was 7.87%, while rural fixed line teledensity was a dismal 1.26%.

Saturday, October 3, 2009

Videocon to buy stake in Elcoteq for $72 mn

MUMBAI: Finnish electronics firm Elcoteq said on Friday that it has reached a preliminary agreement with Videocon Industries for the Indian The announcement comes two days after it called off a similar deal with China’s Shenzhen Kaifa Technology, entered into in July. ET was the first to report the deal on October 1. The loss-making Elcoteq said it aims to conclude negotiations as soon as possible and close the deal by the end of the year. One of the world’s top electronics manufacturing services providers, it designs and makes mobile phones, set-top boxes and flat panel televisions for companies such as Research in Motion, Nokia, Sony Ericsson, Cisco and Philips. Elcoteq operates in 15 countries and has a facility in Bangalore. Last year, it suffered a net loss of e66 million on sales of e3.4 billion. Elcoteq shares had climbed 20% to e1.3 in Helsinki at 8.30 pm Indian time, valuing the company at e138 million. Consumer goods maker Videocon is looking to capture a slice of the growing global electronics manufacturing services business, especially for iPods, iPhones and computers. Globally, telecom and mobile handset makers such as Apple and RIM are increasingly outsourcing manufacturing jobs to low-cost countries as part of their global cost reduction initiatives. VN Dhoot, chairman of the Videocon group, declined to comment on the Elcoteq deal before making an announcement to the Bombay stock exchange. But executives close to the development said Videocon is looking at funding the deal primarily through internal accruals. “Roping in private equity partners would complicate the deal, especially given Elcoteq’s complicated debt structure,” an executive said. Videocon, which acquired Thomson's global colour picture-tube manufacturing business for e240 million four years ago, sees synergies between Elcoteq’s business and its consumer electronics and mobile services businesses, said a person close to Videocon. The Rs 15,000-crore Videocon Group, which derives 60% of its sales from consumer electronics and the rest from oil and other businesses, made abortive attempts to buy Daewoo Electronics in 2006 and Motorola last year. Elcoteq has announced a restructuring plan to lay off around 5,000 staff and close several plants in Romania, Russia and US citing ‘an exceptionally uncertain market situation and general economic development’. In July, as part of its plan to cut costs, it sold a majority of the machinery, equipment and materials at its facility in Tallinn, Estonia, to Ericsson and also transferred around 1,200 employees. | |

We are the biggest foreign investor in India :Sistema

ST. PETERSBURG, Oct. 2 – As trade between the BRIC economies starts to move upwards, India and Russia have now set the more ambitious goal of doubling bilateral turnover to $20 billion by 2015. Indian Commerce and Industry Minister Anand Sharma, currently in Moscow for trade talks said that India and Russia had turned the challenge of the global crisis to advantage as bilateral trade continued to grow despite the 10 percent decline worldwide. Indo-Russian bilateral trade has grown at about 30 percent a year since 2005. Mr. Sharma is leading a 70-member delegation of Indian business leaders to the third Russian-Indian Forum on Trade and Investment.

According to Russian Deputy Prime Minister Alexander Zhukov, Indo-Russian trade increased by 17 percent in the first half-year of 2009 and is expected to grow to US$8.4 billion by the end of the year.

“India is one of the very few countries with whom Russian trade is growing, rather than declining this year,” Mr. Zhukov was quoted as saying in The Hindu.

Mr. Sharma warmly recalled the massive economic aid the Soviet Union extended to India in the post-independence years. “We deeply appreciate your support and help in building the foundation of India’s public sector industry,” Mr. Sharma said. “The concept of a planned economy laid in those years is still very relevant today”. Both sides called for diversification of trade into high-tech areas, such as IT, bio- and nano-technologies and non-conventional energy. Speaking at the forum, Vladimir Yevtushenko, whose multi-billion dollar conglomerate, the Sistema Group, forayed into the Indian mobile communications market through a tie-up with the Shyam Group, said the joint venture, Sistema Shyam Teleservices, was growing at a rate of 500,000 new customers a month and looked set to become an all-India provider of 3G voice and data services next year.

“Today, we are the biggest foreign investor in India,” Yevtushenko said.

Sistema Shyam has offered the Indian government to build a national crisis-management centre, set up a “safe city” program for Delhi and plans to diversify into space communication services on the basis of the Glonass, the Russian analogue of the U.S. GPS.

“Following the independence of India from Britain, India turned to Russia for assistance with collective agriculture development and advice. In certain areas, India’s larger industries are similar in organizational structure to those of Russia and China, having followed the old Soviet model,” says Chris Devonshire-Ellis, the founding partner of Dezan Shira & Associates, currently in Russia evaluating the potential for development in the country. “Although some of those policies have now been discredited as regards optimization of production, India and Russia do share many similar challenges and have long been partners and allies in commerce. It is cross border challenges and relationships such as these that will shape the future of the new world economy, and we look forward to increased bilateral and multinational trade between China, India and Russia developing over the course of the next five years.”

According to Russian Deputy Prime Minister Alexander Zhukov, Indo-Russian trade increased by 17 percent in the first half-year of 2009 and is expected to grow to US$8.4 billion by the end of the year.

“India is one of the very few countries with whom Russian trade is growing, rather than declining this year,” Mr. Zhukov was quoted as saying in The Hindu.

Mr. Sharma warmly recalled the massive economic aid the Soviet Union extended to India in the post-independence years. “We deeply appreciate your support and help in building the foundation of India’s public sector industry,” Mr. Sharma said. “The concept of a planned economy laid in those years is still very relevant today”. Both sides called for diversification of trade into high-tech areas, such as IT, bio- and nano-technologies and non-conventional energy. Speaking at the forum, Vladimir Yevtushenko, whose multi-billion dollar conglomerate, the Sistema Group, forayed into the Indian mobile communications market through a tie-up with the Shyam Group, said the joint venture, Sistema Shyam Teleservices, was growing at a rate of 500,000 new customers a month and looked set to become an all-India provider of 3G voice and data services next year.

“Today, we are the biggest foreign investor in India,” Yevtushenko said.

Sistema Shyam has offered the Indian government to build a national crisis-management centre, set up a “safe city” program for Delhi and plans to diversify into space communication services on the basis of the Glonass, the Russian analogue of the U.S. GPS.

“Following the independence of India from Britain, India turned to Russia for assistance with collective agriculture development and advice. In certain areas, India’s larger industries are similar in organizational structure to those of Russia and China, having followed the old Soviet model,” says Chris Devonshire-Ellis, the founding partner of Dezan Shira & Associates, currently in Russia evaluating the potential for development in the country. “Although some of those policies have now been discredited as regards optimization of production, India and Russia do share many similar challenges and have long been partners and allies in commerce. It is cross border challenges and relationships such as these that will shape the future of the new world economy, and we look forward to increased bilateral and multinational trade between China, India and Russia developing over the course of the next five years.”

Thursday, October 1, 2009

MTS Diwali offer Enjoy Unlimited FREE Local Calls for one Year

To celebrate the festive season MTS India has come up with an exciting Diwali offer for its CDMA Mobile subscribers in Kerala and Tamil Nadu-Chennai telecom circle. MTS the mobile telephony brand of Sistema Shyam TeleServices Ltd (SSTL) today announced the Diwali which give another reason to rejoice with Free Unlimited local calls to stay tune with near and dear.

With “MTS Diwali offer” the subscriber can enjoy MTS-to-MTS Unlimited FREE Local calls for one year and on other local networks call will be chargeable at 1 paisa per second.

With “MTS Diwali offer” the subscriber can enjoy MTS-to-MTS Unlimited FREE Local calls for one year and on other local networks call will be chargeable at 1 paisa per second.

The lifetime validity for comes with this Diwali Pack of Rs.999 and All STD calls at to any network with are charged at 2 paisa per second across India. All Local and National SMS would be charged at 50 paisa per SMS.

After the completion of one year from the date of activation (of Diwali offer), local MTS-to-MTS calls will be charged at 1 paisa per 2 seconds.

If MTS Subscribers interested in availing free MTS-to-MTS local calls can do so with MSaver74 RCV.

After the completion of one year from the date of activation (of Diwali offer), local MTS-to-MTS calls will be charged at 1 paisa per 2 seconds.

If MTS Subscribers interested in availing free MTS-to-MTS local calls can do so with MSaver74 RCV.

Wednesday, September 30, 2009

CDMA operators seen dominating the Indian data card and USB modem space

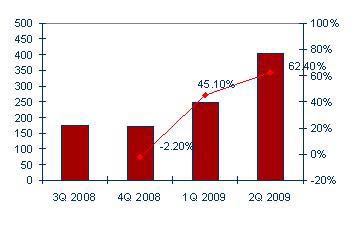

Mobile broadband is yet to enter India in a big way but it seems there is a strong latent demand already for such services in the country. IDC’s first-ever study in analyzing Data Card and USB Modem shipments highlights that the sales for these products were at 0.405 million for the April-June 2009 quarter.

The surge in demand especially in the last six months is due to increasing need of professionals to stay connected while being mobile. Enterprise email communication, corporate applications and personal communication including online transactions an entertainment are seen sfueling the demand for such products.

The shipments in July-September 2008 were at 0.176 million. While in the July-Sep’ 08 quarter it was found that 25 % of the notebooks sold had data card or USB modem the number increased to 80 % by April-June’09 quarter.

In terms of technological platform, the present scenario shows that CDMA service providers are dominating the space with almost 69 % share of the market. This is logical because CDMA enables operators to offer better speeds as compared to GSM operators who are forced to offer inferior speeds over 2G network. Things might change after entry of 3G.

Prices of these products are likely to come down from the current average price of Rs 3,000 thereby assisting in pushing mobile broadband.

IDC says that while the current ecosystem witness’s data cards and USB modems being bundled with service providers’ offerings, the scenario might change and allow open data cards to be available allowing end-users to not only chose their service provider but also the preferred data card.

India Data Card and USB Modem Market Sales (Shipments): ’000s of units, % growth

Naveen Mishra, Senior Analyst, Communications Research, IDC India says, “Going forward we expect convergence to affect USB modems, whereby these devices will not only be used for Internet connectivity but also increasingly for data storage, music (MP3 player) and FM (Radio).”

“USB modems may also see usage as a mobile phone in future avatars as companies experiment with new applications,” adds Naveen.

Only existing CDMA operators allowed to bid for EVDO spectrum

Unlike GSM space where even non-UASL holders and new players will be allowed to bid for 3G spectrum, the government has decided to allow only existing CDMA operators to bid for EVDO spectrum.

“One carrier (2 x 1.25 MHz) of EVDO would be auctioned in circles where adequate spectrum (at least two carrier) is available,” said a DoT note. “Only existing UAS Licencees offering CDMA services will be eligible to bid,” adds the note.

CDMA operators will be allotted EVDO spectrum in the 800 MHz band.

“Specific frequency to be awarded to successful bidders would be decided post the auctions to enhance usage efficiency,” said DoT.

Subscribe to:

Posts (Atom)

Disclaimer

A BLOG FOR ALL THE SHAREHOLDERS OF SSTL (FORMERLY SHYAMTELELINK LTD) TO COME TOGETHER AND DISCUSS ISSUES OF COMMON INTEREST. YOU CAN REACH US AT AMSOST@GMAIL.COM